animated moviesGet together this summer.

Domestic three-dimensional animated film, chanting animation opens the "Oriental Legend Series" with "Falling Dust"; Catch up with the third part of the "White Snake Series", "White Snake: Floating Life", and set the file for Tanabata; The original two-dimensional animated film "Umbrella Girl" with Cat’s Eye as its entry focuses on aesthetic national style and traditional cultural elements.

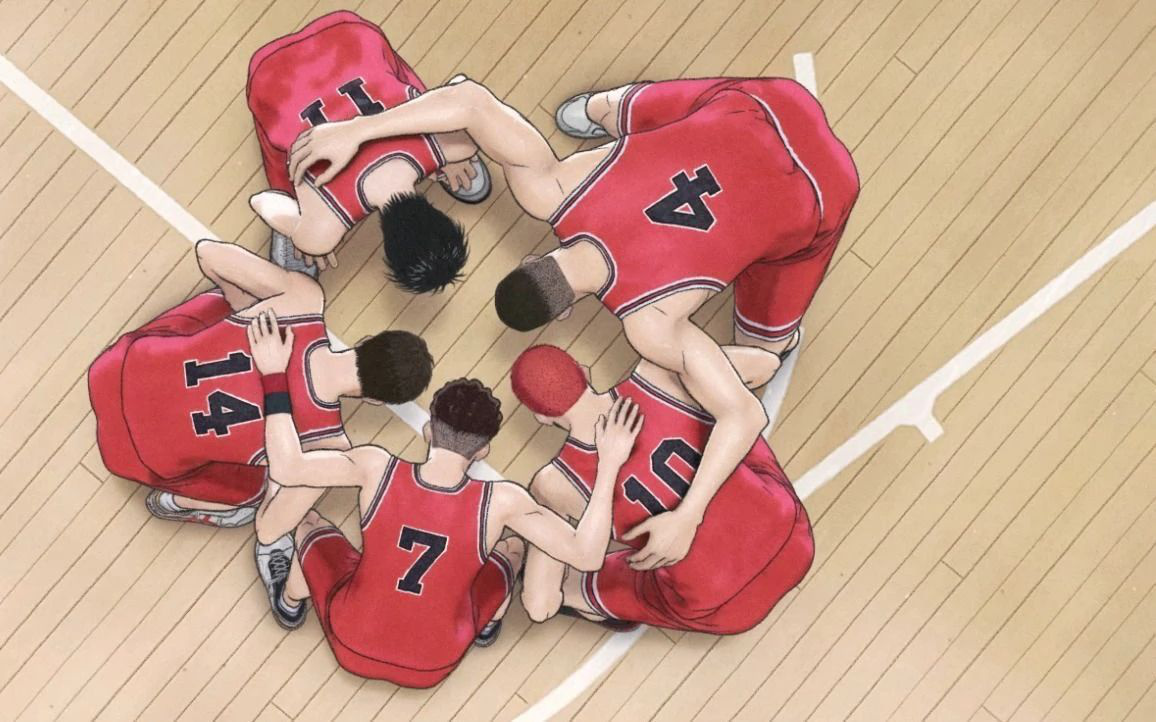

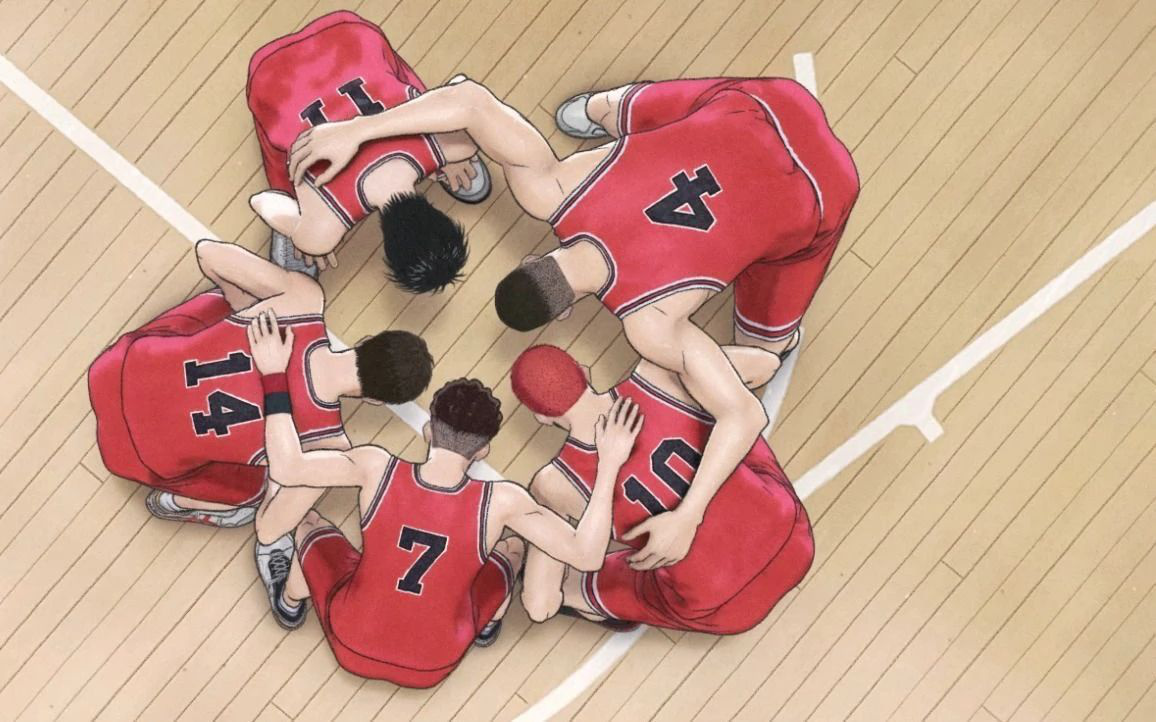

Hollywood’s "Daddy Thief 4", as well as from "Volleyball Boy", "Blue Forbidden Zone" to "Slam Dunk Master", were re-released, and several Japanese IP theatrical versions were introduced to China, focusing on summer release.

From the behind producers’ point of view, in addition to Cat’s Eye, the producer of Umbrella Girl, and bilibili, the producer of Fallen Dust (jointly produced by Youku and mainly released by Taobao Film), Tencent Video and Alibaba Pictures also appeared in the filing and publicity, becoming more direct participants in animated films, and the configuration of animated films also appeared in the list of iQiyi films.

According to the previous statistics of Dongxi Entertainment, in the first quarter of 2023 -2024, the number of animated films filed reached a new high.

In addition to the old animation players such as Light Media, Light-chasing Animation and Huaqiang Fangte, more and more film companies, such as Baina Qiancheng, Huace Film and Television, Huayi Brothers, Confucianism and Italian Film, Chinese Film and Xinshengtang, have started to increase the number of animated films. Companies such as Chinese Online, Guomai Culture, etc., cut into the animation film track either because of asset integration or because of IP incubation.

The excavation of traditional culture is also deepening. In addition to drawing materials from myths and legends, the theme of the Three Kingdoms has become the next hot development direction.

It seems that the animated film track is still alive.

Nowadays, domestic animated films, whether in two or three dimensions, have significantly improved their technical strength and become more and more beautiful. This is almost the primary starting point for talking about domestic animated films.

But in contrast, in the past few years, the topic of "plot" has been relatively invisible, or it has become a short board for some animated films to drag down the box office. Especially two-dimensional animated films are the hardest hit areas.

When the support and feelings for "the rise of the country" are no longer enough to attract the audience into the cinema, commercial animated films must first return to the essence of "content goods". A simple art longboard can hardly make up for the shortcomings of not telling a story well.

The reason is easy to understand, but why did this situation last for several years?

Behind this, it is not only the lack of good screenwriters, but also the systematic problems of domestic animated film product positioning, creative talents, industrialization system, market cultivation and industrial environment.

Individual success

Can’t cover up the shortcomings of most works.

Two-dimensional animation and three-dimensional animation, whether in the film market or video platform, have actually been divided into two different product types, with obvious differences in production processes, target groups, product positioning and so on.

Objectively speaking, although the current craze for animated films in China is more in the direction of three-dimensional animation, from a broader market perspective, a proper balance between two-dimensional animated films and three-dimensional animated films is conducive to the vitality of the industry.

Today’s three-dimensional animated films are relatively closer to real-life movies and gradually accumulate local industrialization systems. The intervention of industrial capital has also brought positive influence. Even if there are few brilliant scripts, on the whole, the average line of the completion and regularity of the works is rising, and the expectations and consensus in the industry are more reference.

In this process, represented by light-chasing animation, once a market-accepted work such as White Snake: Origin is made, industrial pipelines can be continuously optimized along this empirical direction, assets can be reused, and finally their own industrialization process can be precipitated.

But the movie market obviously can’t just have a light-chasing animation.

Senior practitioner of animation industry 3000 (animation producer, Jumping Youth, Mickey and Dali, Work Cell Black, Ace Bartender, etc.); Podcast program world useless anchor) think, "Many popular 3D cinema animations are actually a bit like a collection of big and short videos. With the production level of cinema movies, the big content of the network will be brought to the quality of movies. It seems that there are not many excellent scripts. What most viewers see is the same exaggerated expressive force and plot highlights as big and short videos. "

The advantage of this is that the audience who didn’t watch animation will be brought in in the form of pantomime and movies, and it is mainly aimed at the audience who like national customs, martial arts and fantasy. This gradually solved the basic problem of "why do the audience go to the cinema to watch" faced by animators.

However, the outstanding problems brought about by this are due to the consideration of creative efficiency. Stories are clustered based on traditional culture or online texts, and narrative themes and emotional expressions are extremely repetitive and homogeneous.

As a whole, the production and freshness have driven the audience temporarily, but in the long run, they are also overdrawing the audience’s expectations.

Compared with three-dimensional animated films, the short board of two-dimensional animated films is exposed more thoroughly.

At present, domestic two-dimensional animated films are basically "director-centered", which are created with the idea of "animation art" instead of creating "narrative goods" oriented to a clear audience market.

Cheng Lin (pseudonym, producer of a domestic animation company) believes that, on the one hand, China animation originated from production, and most practitioners do not have a strong sense of story creation. Now, the vast majority of animation production capacity is also taken over by platforms, IP parties and game companies, and practitioners’ thinking will focus on how to make better, rather than how to create better stories.

On the other hand, the vast majority of animation directors are from fine arts and animation majors, and their ability and energy are mainly focused on animation creation itself. In the mature animation industry environment, good producers and other roles are needed to help balance the content quality and creative speed. However, at present, many domestic animation producers take cost as the main assessment standard, rather than focusing on the attractiveness of the content.

In this case, the director, as the core of animation creation, may fall into the blind spot of trying his best to present what he wants to express when making original content, unaware that there is a problem in the initial script structure.

"I have communicated with many animation teams and will say that your works are already excellent in my eyes. But they just feel that the production is not fine enough. Pay great attention to the quality of the picture, but may ignore the screenwriter and content. "

Cheng Lin said that there are fewer works in China that want to tell a complete story patiently with animation, and more hope that the art will burst and then there will be something brilliant in a certain plot. "I think this will attract more traffic or investment."

However, from the audience’s point of view, many people can’t tell the difference in details that they have invested a lot of money in the production process.

Some animation publicity will emphasize what new technologies are used and how much money is invested to make the picture better, but the audience can’t understand.

When the art reaches a certain critical point of quality, the standard for the audience to judge the quality more intuitively is the story.

Fortunately, many animation directors and core creators have realized these problems.

Why do you say animated movies?Bad plot

It’s easy to rot to the end?

One of the similarities between three-dimensional animated films and live-action films is that after the content is shot and produced, the plot can still be adjusted by editing in the later stage. However, the IP settings based on China traditional culture or the audience with a fixed circle have solved some understanding obstacles.

Therefore, even if the plot can’t be over 60 points, as long as the overall production is innovative, the audience can accept it, but it will only affect the long tail of the box office and lower the expected upper limit of the box office.

However, if the plot of two-dimensional animation is bad, there is almost no room to save the failure, and even if you know the existence of the problem, you can only continue.Because all the contents of two-dimensional animation are drawn, it requires that at the beginning of the project, it is necessary to determine each line, the duration of each action performance and the direction of each shot.

Of course, when discussing the plot of domestic two-dimensional animated films, we can’t ignore the fact that the domestic two-dimensional animated films released in the past two years generally have a development cycle of more than five years, that is, at least five years ago.

As a result, if a two-dimensional animated film is made for five years, the scheme of script, split shot, editing, etc. has been determined as early as the second or third year, and everyone else must follow this scheme.

That is to say, in recent years, even if you finally want to modify a certain plot, you can only adjust some emotional transmission or lines under the condition of the same duration, and you can’t adjust it by post-editing. Otherwise, it will face huge cost and manpower waste.

Moreover, animated films often need outsourcing support because of too much painting. After a cycle of service, the outsourcing team usually has no capacity gap or is willing to pay the cost, and then intervene to help modify it later. It is unrealistic to rely entirely on the in house team from a cost perspective.

Therefore, in recent years, with the rapid development of domestic animated films, even if more capital and external professionals enter, it is difficult to solve the hidden dangers buried in two-dimensional animated films five years ago.

Then, if the director has the consciousness of telling a good story from the beginning, or finds a good screenwriter, can it be solved?

A problem to be confronted first.

The process of film industry is different.

Objectively, it can solve some problems, but before answering this question, there is a fundamental problem that needs to be faced directly.

That is to say, the ability requirements of directors, screenwriters and producers of animated films are actually different from those of animation talents in general. There is a higher demand for the consciousness of professional division of labor for each type of work. It can even be said that the professional degree of division of labor will directly affect the results.

Although there is a shortage of excellent animation talents, in the face of the huge industrial process of film, the shortage of talents is not outstanding, but the lack of basic discs.

Even in the Japanese market, where there are enough outstanding talents and even generalists, it is the same.

Mamoru Hosoda, a well-known animation director, and The Battle in Summer and The Girl Through Time and Space, both of which were directed, were highly praised. However, from the beginning of Son of the Monster, he left his familiar screenwriter partner, Satoko Okudera, and became a director and screenwriter himself, and the quality and reputation of his works went down all the way.

3000 said that only a few talented directors can jump out of the routine of the division of labor process.For example, in Miyazaki Hayao, there is no script, so we start with the split lens, and then fill in the lines to draw the movie like a cartoon.

Or I like stories very much, have enough energy and enthusiasm, and can do a part-time job to a certain extent. For example, 3000 Japanese animation "Jumping Youth" as producer won the "Best Animation Screenplay Award" in the 29th Magnolia Award. One of the directors, Chuhe Dumei, works as a screenwriter because he likes this theme very much and has the ability to create a good script.

"But most people don’t have this cross-border capability. Cartoonists can control the length of time in comics, but animation may not be able to control it. " 3000 said.

A typical example is Takehiko Inoue, and the theatrical version of Slam Dunk is the director and screenwriter himself.

Takehiko Inoue’s flashback and pause methods used in cartoons can’t be directly used in animation. Because the animation time is constantly passing forward, how can the memory lens be inserted without being abrupt? In comics, you can use big special effects words to represent sound effects, and you can also write small lines next to characters to show your psychological activities, but what about animation?

As a result, the audience’s main criticism of the theatrical version is that some flashbacks destroy the narrative rhythm or some emotions are not in place.

In 3000′ s view, this is mainly because Takehiko Inoue, as a cartoonist, lacks experience in time control and sound coordination required for animation. And all these matters must be determined in the early stage of the project.

When cartoonists and animators change to directors and screenwriters in China, they will also face the problems of lack of experience and energy.

How to crack it?

Professional animation writers are scarce.

Back to the starting point of this article, the perspective of screenwriter problem and domestic.

The domestic problem is that professional animation writers are absolutely scarce in the animation film industry, even in the whole animation industry.

Specific to the creation, there are obvious differences between the demand for scriptwriters in animation and other content products, and the demand for creative ability is different from that of ordinary scriptwriters. The scriptwriters of live-action movies and television turn to animation, especially two-dimensional animation, and may not be able to adapt.

Even a three-dimensional animated film, which can be compared with the creative thinking of live-action movies, leaves much more room for writers than live-action movies, and there are many places where imagination needs to be exerted, which cannot be supplemented by live-action performances in the later stage.

However, the realistic survival problems and the trend of local industries also make some problems impossible to solve from people’s professional ability.

In China, the budget of many animation projects is not inclined to scriptwriters, and the income and growth curve that scriptwriters can get from the animation industry are far lower than those of real-life movies and even short plays.

Wang Lan (pseudonym), who worked in Hollywood and local animation companies successively, once cooperated with DreamWorks Animation. At that time, the creative mode of DreamWorks was that each work had a lead screenwriter who was responsible for the big structure of the whole story.

The lead screenwriter is generally not a special animation screenwriter, but has a lot of experience in large-scale film projects and can complete a very formal film structured script. On the basis of this script, how to play the characteristics of animation requires more than a dozen animation directors to complete it together.

For example, if an animated film is 120 minutes long, it needs 12 directors, each of whom is responsible for 10 minutes, and finally the general director will co-ordinate it. Each director has 3-5 years, specializing in grinding these 10 minutes of content, turning the script into a mirror and adding a lot of his own ideas, which is equivalent to a second screenwriter.

There is a lack of special personnel in China to sort out the structure and logic of the whole script and turn it into an animated film model. If it is a comic adaptation, the budget of most animation companies will not be to invite a special screenwriter, but to invite the original author to participate, and then the director will control this link.

After returning to China, Wang Lan came into contact with many domestic animation projects."There is an animated film with a total investment of about 50-60 million, of which only 20,000 is reserved for the screenwriter",Wang Lan said that she discussed with the director about increasing the scriptwriter’s budget. The director thought that the animation production part was more expensive, and the cost budget was not enough, so there was really no extra money for other parts.

"A reality TV series, screenwriter fee of 300000 is not much. Can understand the director’s difficulties. However, the film’s contribution to the story is so small that it is unreasonable in any way, "Wang Lan said.

Overseas experience

Many of them can’t be compared

Localization of industrial processes and creative elements in the overseas mature three-dimensional system, from a few minutes of short films, dozens of minutes of TV animation to more than 100 minutes of animated films, has a relatively clear reference and opportunities to participate in exercise.

Therefore, learning from overseas mature experience in the growth stage has been relatively smooth for three-dimensional animated films. Such as chasing light animation, it can be regarded as gradually exploring the road of local characteristics.

However, two-dimensional animated film, as an industry that relies more on "people" itself, is actually difficult to obtain systematic experience reference.

In 3000′ s view, the main reference object of global 2D animation creators is Japanese animation. At present, the audiences of 2D animation all over the world are mostly fans who like Riman, and they will evaluate their domestic 2D animation with their impressions of Riman.

When making an animated work with a local theme in two dimensions, it is difficult to answer the following questions: how to attract users to watch it, and what degree of vision is needed to attract people. When the creators put all their energy into these two issues, how to protect the plot has become another problem.

From Japanese animation to domestic animation, there are many places that are difficult to directly target.

First of all, the Japanese animation industry, because of the heavy workload and similar level, and most of the employers and producers have cooperated with more than three works, has reasonable and unified expectations for the finished products, and the cost of follow-up communication is correspondingly reduced.

3000 said that hundreds of TV animations and dozens of theatrical animations are released every year in Japan, and the amount of scriptwriters’ practice is very large. Not only in the field of animation, but also because most Japanese animations are exaggerated and have certain commonalities with stage plays and Japanese dramas, animation writers and stage writers are almost the same, and they can also be exercised in these fields. So many works are run-in, and each has a familiar partner, which is more efficient.

In contrast, the rise of modern animated films in the China market, whether in three-dimensional or two-dimensional, began with The Return of the Great Sage. According to the calculation of one work in 4-5 years, the best creators may have produced 2-3 works, which is far from the accumulated experience of Japanese animators. The market naturally cannot form a tacit understanding, such as watchingBy the composition of the team, we can predict what the finished product of this work will be like.

Secondly, the logic of voice in Japan is different from that in China, which also leads to the transition of Japanese animation, which is different from the logic used and liked by China creators.

For example, the final climax of many China’s works is to bring down the bad guys together and put forward solutions to all problems. However, Japanese animation, influenced by the Japanese national character’s unwillingness to publicly express their attitude towards one thing, often does not give a clear solution in the end.

Therefore, many Japanese animations are considered as "unfinished", because Japanese creators don’t want to make such a statement at the end, which often leads to a nihilistic ending.

"If this logic is moved to domestic animation, it will basically lead to an unfinished or nondescript evaluation. However, if we only give a definite ending at the end, the previous plot will not be done in place, and it will still make the audience feel puzzled, "said 3000, which is also a common problem of many domestic two-dimensional animations.

Furthermore, influenced by the concept of domestic original quality products, domestic animation story creation is easy to fall into putting personal expression labels in the works, so as to highlight the uniqueness of creation, and ultimately it is difficult to reach most audiences and form market-oriented work recognition.

The field of three-dimensional animated films has put down the burden. The series of "deities", "new culture" and "Oriental legends" that pursue light are all based on popular cultural and social issues and pursue maximum recognition.

However, in the field of two-dimensional animated films, few creators are willing to use popular and verified structures and settings, and expand a story that conforms to the new media form under such structures and settings.

"This is also the feeling of many people in the industry. Domestic two-dimensional animated films are too much like the personal expression works of the director center. However, the cost required for this is not what a director can bear, "Wang Lan said.

However, 3000 also believes that most domestic two-dimensional animated films choose originality, which is helpless. "Everyone knows that original animation is risky, but in the domestic market, animated films are still more certain in commercialization than comics. butReady-made IP is expensive, so many animation companies don’t want to do OEM all the time, so they can only choose to be original."

No bad animators.

Looking for a plan to adapt to local conditions.

After the local three-dimensional animation has reached the level of industrial production once a year, it may be able to solve some talent problems and process problems with funds as the fulcrum.

But the difficulty of two-dimensional animated films is whether they can survive to the point where the funds are willing to continue.

To some extent, today’s two-dimensional animated films, much like indie games, all face the problem of "the second work".

It means that "people" are the greatest assets.

If the first work fails, it will be difficult to get another investment, and there will be no other source of income, so the team can only be dissolved, which means that the experience of the last work is almost wasted.And even if the first work is successful, we must ensure that the team is not lost, otherwise even if it is the same company, it will mean starting all over again.

The two-dimensional animation is still recognized as valuable by the market, not only because of the fans affected by the Japanese spread, but also because of the demand for two-dimensional animation in the game.

You can see a lot of two-dimensional game PV in the market, which is beautifully made and deeply loved by players. However, game PV and narrative content products are two different things. The narrative function undertaken by the game PV is mainly used to awaken the good memories of gamers when they play. Many emotional rendering, role and world view cognition have been completed in the game. In contrast, the entertainment concentration of animated films is much lower than that of games.

3000 believes that animated films should be given more time, because the industry is in the process of gradual and spiral rise.

Most of the animated film projects that have been released today were established a few years ago. The works presented now, in a sense, are also paying for the past.

Besides animated films and operas, such as Cheng Lin, they are also exploring different forms of animation. for exampleShort animation (there are also some short animation plays in some directions)This more efficient and relatively light-weight content form helps animation companies to jump out of the contract-making cycle, face the C-end audience, incubate their own IP, and explore the combination with brands and cultural tourism in the future.

Although there are many complaints and challenges, animators have not "messed up", some problems are realized by more and more people, and eventually some localized solutions will be found.The key now is to continue to find suitable product positioning and business model for animation, including solving the problem of "why do users want to watch".