There is an IPO in the "gutter oil": the couple of Fengbei biological controllers have "cashed out" more than 50 million in five years.

May 24, 2023, Shanghai, 2023 China International Agrochemicals and Plant Protection Exhibition, Fengbei Bio-booth. People’s visual data map

The once-shocking waste oil has been made into an "environmental good business" by this company, which is not only exported overseas, but also plans to be listed on the A-share main board.

Recently, the initial IPO application of Suzhou Fengbei Biotechnology Co., Ltd. (referred to as "Fengbei Bio") has been accepted by Shanghai Stock Exchange. This is a high-tech enterprise in the field of comprehensive utilization of waste resources, mainly producing resource products from waste oil. Waste oils and fats refer to animal and vegetable oils and various by-products and scraps of oils and fats that do not meet the edible standards and are produced in the process of catering service, food processing industry, oil refining and oil storage, and then become waste oil after flowing into sewers.

According to the prospectus, biodiesel is the best flow direction of waste oil at present. Biodiesel has low requirements on the index of raw material waste oil, covering almost all kinds of waste oil. Besides being used as biofuel, biodiesel can also be used to produce bio-based materials, with broad application prospects and strong economic benefits.

The fundraising project has been put into production.

According to the data in the prospectus, from 2020 to 2022 (referred to as the "reporting period"), the operating income of Fengbei Bio was 790 million yuan, 1.296 billion yuan and 1.701 billion yuan respectively, and the net profit attributable to the owners of the parent company was 48.9986 million yuan, 102 million yuan and 133 million yuan respectively.

Fengbei Bio’s main business income is mainly the comprehensive utilization of waste oil resources, supplemented by oil chemicals business. During the reporting period, the sales revenue of the comprehensive utilization of waste oil resources accounted for 69.93%, 77.81% and 79.53% of the main business income, respectively.

In addition, during the reporting period, the overseas sales revenue of Fengbei Bio was 163 million yuan, 446 million yuan and 672 million yuan respectively, accounting for 20.66%, 34.50% and 39.41% of the main business income respectively. Fengbei Bio’s export products are mainly used in the European market.

Fengbei Bio said in the prospectus that only a few large-scale enterprises in China have the ability to treat low-quality waste oil. For example, Zhuoyue Xinneng (688196.SH) is the largest biodiesel enterprise with the largest export volume in China, and its existing biodiesel production capacity is 500,000 tons. Jiaao Environmental Protection Co., Ltd. (603822.SH) is a large-scale and influential biodiesel producer with product quality conforming to EU EN14214 standard. Its existing biodiesel production capacity is 300,000 tons. The main products of Longhai Bio (836344.NQ) are biodiesel and plant asphalt, and the existing production capacity of biodiesel is 60,000 tons. At present, Fengbei Biodiesel has an existing production capacity of 90,000 tons and a production capacity of 350,000 tons under construction.

According to the data disclosed by Biofuels Annual-China, from 2020 to 2022, the output of biodiesel in China was about 1.28 million tons, 1.61 million tons and 2.14 million tons, while the output of abundant biomass was 50,000 tons, 75,000 tons and 90,000 tons in the same period, corresponding to the company’s biodiesel market share of about 3.91%, 4.66% and 4.21%. Fengbei Bio claims to be in the first echelon of the comprehensive utilization industry of waste oil resources in China.

It is reported that Fengbei Bio intends to raise 1,000,000 yuan in this IPO, which is mainly used to invest in "projects with an annual output of 300,000 tons of methyl oleate, 10,000 tons of industrial-grade mixed oil, 50,000 tons of agricultural microbial agents, 10,000 tons of compound microbial fertilizers and by-products of biodiesel 50,000 tons and glycerol 82,000 tons". In the future, with the investment projects raised by the funds put into production, the biological yield of Fengbei is expected to increase significantly. According to the data in the prospectus, according to the feasibility study report, on the premise that all economic factors are in line with the expectations of the feasibility study report, the company expects to increase its operating income by 3.944 billion yuan (excluding tax) every year after the project is fully put into production.

However, we need to be alert to the risks brought by overcapacity in the industry. Fengbei Bio emphasized that as several mainstream biodiesel enterprises have successively disclosed large-scale plans for biodiesel production capacity expansion, with the gradual implementation of new production capacity, there may be an overall imbalance between supply and demand in the future due to accelerated production capacity or production capacity exceeding expectations, which will lead to intensified market competition.

Before IPO, "cash out" exceeded 50 million yuan.

It is worth noting that before the IPO, Pingyuan, the actual controller of the company, and his spouse Han Linlin cashed in more than 50 million yuan by selling the equity of the controlling company to Fengbei Bio and paying dividends.

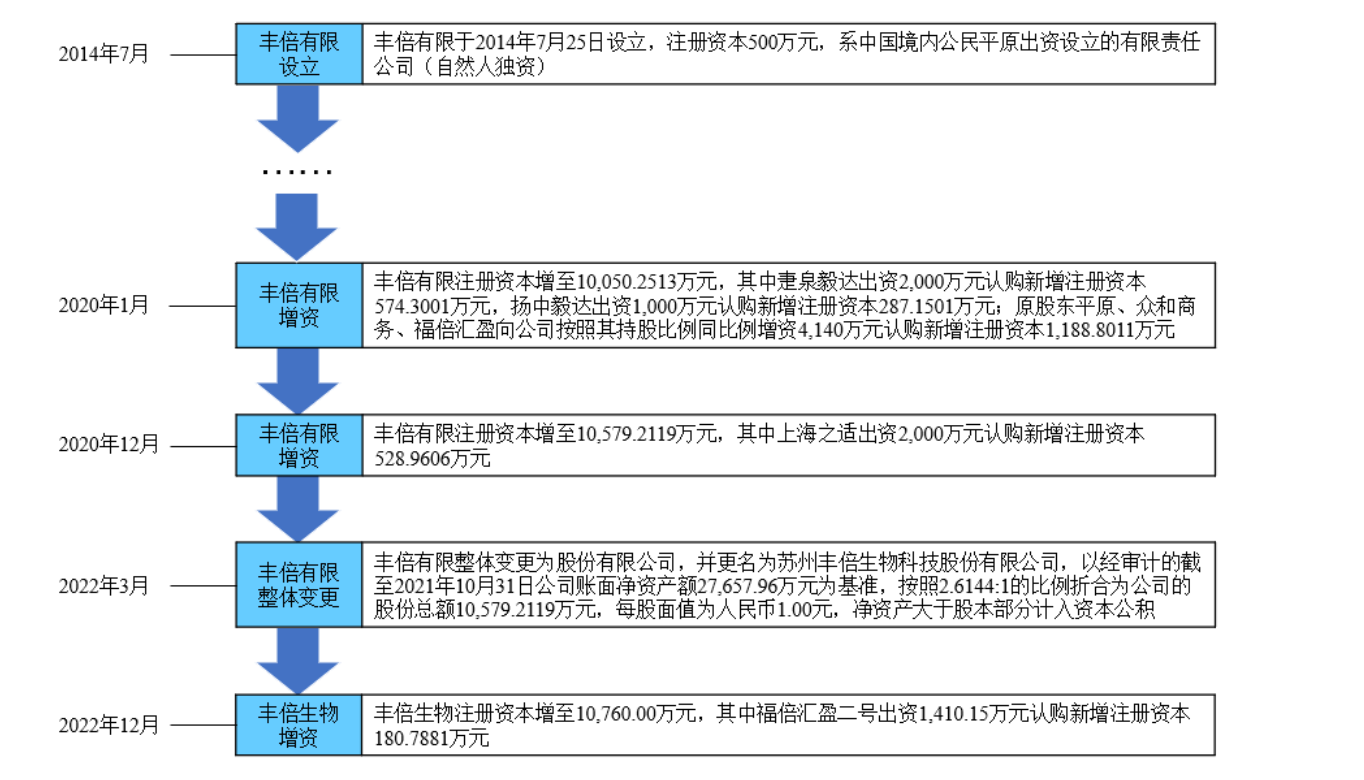

Pingyuan was founded in July 2014, and its predecessor was Fengbei Limited, which was positioned as the main body of research and development and mainly engaged in oil and fat chemicals related business; In the same period, Pingyuan developed the comprehensive utilization business of waste oil resources through its friends, Grease and Weige Bio, controlled by Han Linlin or his spouse, while Fuzhiyuan also engaged in the oil chemicals business like Fengbei Limited.

Before being acquired, Vig Bio, Fortune Source and Liangyou Oil were all controlled by Pingyuan or its Han Linlin. However, in 2018, Fengbei Bio said that in order to reduce related party transactions and horizontal competition, and further enhance business synergy, it announced the acquisition of all the shares of Weige Bio, Liangyou Grease and Fuzhiyuan.

According to the information in the prospectus, before the reorganization, Han Linlin and Wei Liang (son of director Wei Guoqing) held 70% and 30% of the shares of Weige Bio respectively. In December 2018, Han Linlin transferred 100% equity of Weige Bio to Fengbei Co., Ltd. for 33.68 million yuan and Wei Liang for 14.4 million yuan.

Pingyuan and Han Linlin hold 80% and 20% of the shares of Fuzhiyuan respectively. In December 2018, Pingyuan transferred its 100% equity of Fuzhiyuan to Fengbei Co., Ltd. at a price of 4,073,800 yuan and Han Linlin at a price of 1,018,500 yuan.

Li Yin and Wei Liang hold 70% and 30% shares of Liangyou Oil respectively. Among them, the equity held by Li Yin was entrusted by Pingyuan for management reasons. In January 2019, Li Yin transferred 100% equity of Liangyou Grease held by Li Yin to Weige Bio at a price of 700,000 yuan and Wei Liang at a price of 300,000 yuan.

After this time, Pingyuan and Han Linlin successfully cashed in 39.4723 million yuan.

In addition, it is worth noting that Fengbei Bio also paid a large dividend before the IPO. On March 4, 2022, Fengbei Limited held the first shareholders’ meeting in 2022, and deliberated and passed the proposal on profit distribution, with a total profit of 15 million yuan. At that time, Pingyuan directly and indirectly controlled 85.40% of the shares of Fengbei Bio, and the dividend amount was about 12.75 million yuan.

That is to say, before IPO, Pingyuan and Han Linlin made equity transfer and cash dividend, and the cash amount reached 52,222,300 yuan.

The asset-liability ratio is high

It is worth noting that the combined asset-liability ratio of Fengbei Bio is 34.67%, 36.20% and 45.25% respectively, showing the status quo of rising year after year. In this regard, Fengbei Bio said that the increase in asset-liability ratio during the reporting period was mainly due to the company’s new long-term loans for project construction investment in 2022, and the company’s asset-liability ratio remained at a reasonable level during the reporting period.

Fengbei Bio said that after the raised funds are in place, the company’s total assets and owner’s equity will increase substantially, and the level of asset-liability ratio will decrease, which will help improve the company’s debt financing ability, optimize the company’s capital structure and enhance its ability to prevent financial risks.

It is worth mentioning that Pingyuan, the actual controller and chairman of Fengbei Bio, directly held 59.78% of the shares, indirectly controlled 16.94% and 8.68% of the shares through Zhonghe Business and Fubei Huiying, and controlled 85.40% of the shares of the company in total. After this issuance, Pingyuan is still in an absolute holding position, which can have a significant impact on the company’s production and operation decisions.

Fengbei Bio’s external financing activities are not active. Before the IPO, only two external institutions were introduced. In December 2019, Yida Capital invested 20 million yuan through Yuquan Yida and 10 million yuan through Yangzhong Yida respectively, with an average holding cost of 3.48 yuan per share.

In December 2020, Shanghai Zhishi Enterprise Management Consulting Partnership (Limited Partnership) (referred to as "Shanghai Zhishi") subscribed for part of the registered capital with an average holding cost of 3.78 yuan per share. Between the two financing, the post-investment valuation of Fengbei Bio has increased from 370 million yuan to 400 million yuan, and there has not been much change.

According to official website of Yida Capital, Yida Capital was established by the internal mixed ownership reform of Jiangsu High-tech Investment Group, a well-known venture capital institution. Before the final IPO, Yida Capital held 5.34% of shares through Yuquan Yida and 2.67% of shares in Yangzhong Yida. Shanghai Yishi’s shareholding ratio is 4.92%.